THE SALE AND PURCHASE OF ALCOHOL AND ALCOHOLIC BEVERAGES IN THE EUROPEAN UNION UNDER DUTIES PAID

Excise duties are governed by European legislation, including:

- Council Directive 2008/118/EC on the general arrangements for excise duty, repealing Directive 92/12/EEC

- Commission Regulation (EC) No 684/2009, implementing Directive 2008/118/EC with respect to computerised procedures for the movement of excise goods under duty suspension

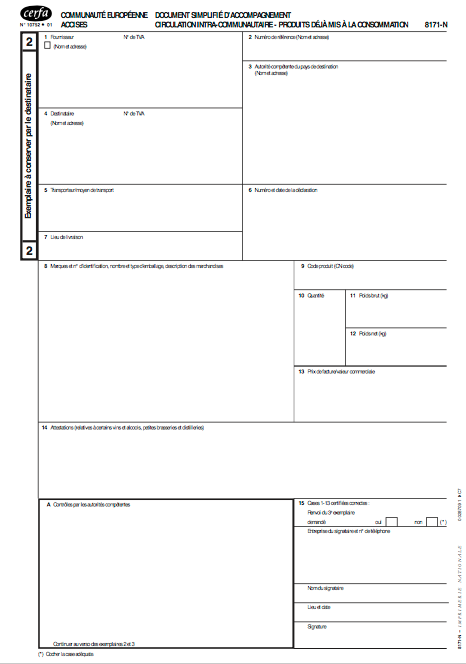

- Commission Regulation (EEC) No 3649/92, relating to the simplified accompanying document for intra-EU movement of excise goods released for consumption in the country of departure

- Commission Regulation (EC) No 31/96, on the certificate for exemption from excise duties

- Commission Recommendation 2000/789/EC, providing guidelines on the authorisation of tax warehouses

Excise duties become payable as soon as the products are released for consumption. The European Union sets minimum excise duty levels for each category of product, but Member States are free to impose additional national taxes.

The movement of alcohol and alcoholic beverages with duties paid within the European Union remains subject to customs declarations.

Our firm, specialized in excise duty law, can assist you throughout these procedures.

INTRA-COMMUNITY MOVEMENT OF ALCOHOL AND ALCOHOLIC BEVERAGES

A new directive (2020/262), which replaces the previous regime for B2B transactions involving duty-paid alcoholic products within the EU, came into effect on 13 February 2023.

Economic operators now have two options for acquiring alcoholic products within the European Union for resale in France:

Movement under duty-paid arrangements with a professional located in another Member State;

Movement under excise duty suspension arrangements with a professional in another Member State.

Regarding duty-paid movement:

Economic operators engaging in duty-paid trade must obtain the status of certified consignor and certified consignee. These statuses are now mandatory to send or receive products already released for consumption between Member States.

If your supplier already holds the status of authorised warehouse keeper or registered consignee, they will necessarily be entitled to act as a certified consignor.

As the recipient, you will be liable for the excise duties in France, the destination Member State.

The consignor may then claim a refund of the excise duties paid in the Member State of dispatch.

Deliveries and receipts of alcohol and alcoholic beverages subject to excise duties under the « duty-paid » regime must be accompanied by a consignment document issued by the consignor. This document must physically accompany the goods during transport.

Our firm can assist you with all the necessary formalities and obligations arising from this new legal framework.

Download the Form: Cerfa No. 10752*01

The information required in boxes 3, 6, 9, and 13 of the form is not mandatory for commercial documents used as a simplified accompanying declaration when the products are circulating exclusively within French territory.